Tax Efficiency

Optimised for UN pensions

Mediterranean Lifestyle

Comfortable EU retirement base

The United Nations Pensions Programme in Malta provides a tax-efficient residency solution for retired UN officials. Designed to offer favourable tax treatment on UN pensions, this programme allows beneficiaries to reside in Malta while enjoying its Mediterranean lifestyle and EU benefits. Applicants must meet specific eligibility criteria and establish residence in Malta.

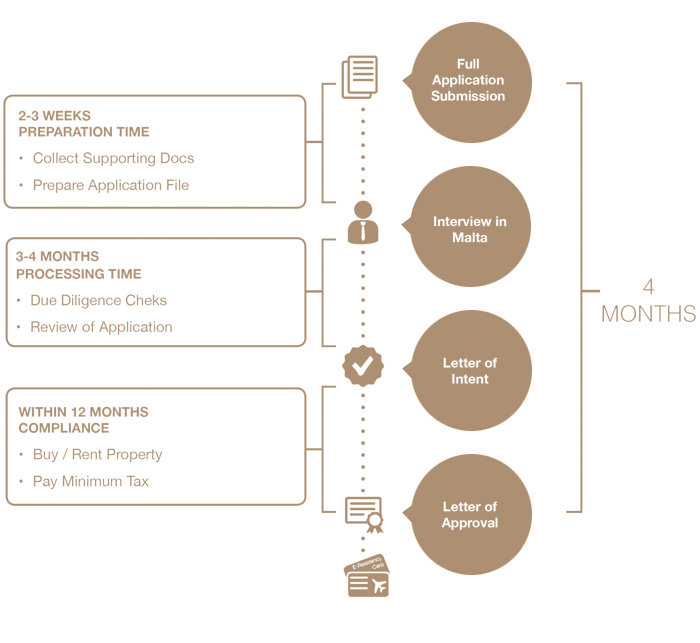

The United Nations Pensions Programme builds on the success of Malta’s reputation in attracting expatriates seeking an alternative residence in a jurisdiction with a favourable tax regime, and a Mediterranean lifestyle. The process to become a Malta resident under this Programme is completed within 3 months, after which, the applicant enjoys Schengen residency and a tax flat rate of 15% on income remitted to Malta. To be eligible for the United Nations Pensions Programme, one must ensure that 40% of the UN Pension is received in Malta. One is also required to buy/rent a residence in Malta and pay a minimum annual tax of €10,000.

Taxation

Maltese residents are not subject to tax in Malta on foreign sourced income not remitted to Malta, nor are they subject to tax on any foreign sourced capital gains whether remitted to Malta or not. Beneficiaries under the United Nations Pensions Programme are exempt from taxation on their UN pension income or widows’ benefit received in Malta. Income arising outside Malta which is remitted to Malta by the beneficiary or his dependants is taxed at a special tax rate of 15%. Any income of the beneficiary or his dependants, generated in Malta is taxable at a flat rate of 35%.

CAPITAL CITY: Valletta LANGUAGES:Maltese, English TIME ZONE:Central European Time Zone (UTC+01:00) CURRENCY: Euro € TOTAL AREA:316 km² POPULATION:417,432 NEAREST COUNTRY:Italy, 255 km SCHENGEN STATUS:Full Member

- Fast Process of operation in 3 Months;

- No Income Tax on the UN Pension Income;

- Presence is not Required;

- Remittance is a Basis of Taxation for 15% Flat Rate;

- Applicant is getting Schengen Residence.

Benefits

Favourable pension tax treatment

Malta offers a special tax status for retired UN officials, ensuring that UN pensions are taxed at a beneficial rate, maximising retirement income.

Access to European benefits

Residency in Malta provides access to EU healthcare, travel, and lifestyle benefits, enhancing quality of life for retirees.

Extend benefits to dependents

The programme allows eligible family members to be included, offering a secure and comfortable environment for loved ones.

Climate and culture appeal

Malta’s warm climate, rich history, and English-speaking environment make it an ideal retirement destination.

Robust legal framework

Malta’s legal system ensures long-term security and stability for residents under the UN Pensions Programme.

Gateway to Europe

Malta’s location offers easy access to European cities and international travel routes.

The United Nations Pensions Programme regulations were enacted by virtue of Legal Notice 184 of 2015, under the Maltese Income Tax Act. The scope of these regulations is to determine the conditions of individuals residing in Malta under the United Nations Pensions Programme.

Secure your retirement in Malta with tax-efficient residency.

- Beneficiaries must be in receipt of a UN Pension of which at least 40% received in Malta;

- Pay a non-refundable administrative fee (€4,000) to the Commissioner for Revenue;

- Buy property in Malta, min €275,000 or Gozo, min €220,000 or rent property in Malta, min €9,600 or Gozo, min €8,750 (annually);

- Pay a minimum annual tax in respect of the income arising outside Malta which is received in Malta excluding UN pension income or Widow’s benefit (€10,000) and an additional (€5,000) in the event that both spouses are in receipt of a UN Pension;

- Applicant should be covered by an EU Health Insurance Policy.

Who is this for

This programme is ideal for retired United Nations officials receiving a UN pension who seek a tax-efficient and secure residency in Malta.

- Retired UN employees

- UN pension recipients

- International retirees

- Individuals seeking EU residency

Why this country

Why Malta

Malta is a stable EU member state offering a high quality of life, excellent healthcare, and a welcoming environment for retirees. Its strategic location and favourable tax regime make it an attractive destination for UN pensioners.

- Capital: Valletta

- Currency: Euro (€)

- Languages: Maltese & English

- Visa-Free Countries: 190+

- Time Zone: CET

- Nearest Country: Italy

Key Contacts

Dr. Jean-Philippe Chetcuti

Dr. Antoine Saliba Haig

Magdalena Velkovska

Secure your retirement in Malta with tax-efficient residency.

Requirements

Legal Basis for UN Pensions Programme

The programme is governed by the Maltese Income Tax Act and specific guidelines issued for UN pensioners, providing a legal basis for favourable tax treatment and residency rights.

Who Qualifies for the Programme

Applicants must be retired UN officials receiving a UN pension and must establish residence in Malta. Additional criteria may apply based on family inclusion and property requirements.

Minimum Requirements

Applicants must demonstrate stable pension income and secure adequate accommodation in Malta. No fixed investment threshold applies.

Due Diligence & Approval

Applications are subject to due diligence checks and must be approved by the Maltese authorities. Documentation of UN pension status is required.

Process/Timeline

Assess eligibility and goals

Begin with a consultation to determine eligibility and outline the application process tailored to your retirement needs.

Gather required documentation

Collect and prepare documents including proof of UN pension, identity, and accommodation in Malta.

Submit to authorities

Submit the completed application to the Maltese authorities for review and due diligence.

Receive approval and relocate

Upon approval, establish residence in Malta and begin enjoying the benefits of the programme.

FAQs

[question]What is the United Nations Pensions Programme in Malta?[/question]

[answer]It’s a residency programme offering favourable tax treatment for retired UN officials who choose to reside in Malta.[/answer]

[question]Who qualifies for the UN Pensions Programme?[/question]

[answer]Retired UN officials receiving a UN pension and meeting Malta’s residency requirements are eligible.[/answer]

[question]Is there a minimum investment required?[/question]

[answer]No fixed investment is required, but applicants must show stable pension income and secure accommodation.[/answer]

[question]Can family members be included?[/question]

[answer]Yes, eligible dependants may be included in the application for residency.[/answer]

[question]What are the tax benefits of this programme?[/question]

[answer]UN pensions are taxed at a favourable rate under Maltese law, maximising retirement income for beneficiaries.[/answer]