Flexible Residency Options

EU and non-EU pathways

Family Inclusion

Spouse and children eligible

The Swiss Residence Permit offers a prestigious route to European residency for both EU and non-EU nationals. With options for retirement, investment, and business relocation, applicants benefit from Switzerland’s high quality of life and favourable tax regime. The permit is valid for up to five years and can lead to permanent residency and citizenship. Family members including spouse and children may also be included.

Swiss Residence Permit is available to both EU and non-EU citizens. EU citizens may opt for Swiss residency on the basis of employment or the lack of it, whilst non-EU citizens may obtain a residence permit for retirement, investment or business purposes. A Swiss Residence Permit is valid for five years and may lead to Swiss permanent residence, as well as, citizenship. Benefits of obtaining a Swiss Residence Permit may also be extended to the family since the spouse and children are also eligible for the Programme.

- Include spouse and children;

- Non EU / EFTA valid for 1 year EU valid for 5 years;

- Fast process of preparation;

- Leads for Permanent Residency&Citizenship;

- Favourable tax system.

Benefits

Quick permit processing

Applicants benefit from a streamlined process that enables fast acquisition of Swiss residency. EU citizens enjoy privileged access, while non-EU nationals can apply through retirement, investment, or business relocation. The process is designed to minimise delays and maximise efficiency. This ensures timely relocation for individuals and families.

Spouse and children eligible

The Swiss Residence Permit allows applicants to include their spouse and children in the application. This ensures family unity and access to Switzerland’s world-class education and healthcare systems. Dependants enjoy the same residency rights as the main applicant. It’s an ideal solution for families seeking stability and opportunity.

Attractive fiscal environment

Switzerland offers a competitive tax regime for residents, especially non-EU nationals. Foreigners are exempt from global income tax unless they reside in Switzerland for more than 183 days per year. Income derived from Swiss sources is taxed at reasonable rates. This makes Switzerland a strategic choice for wealth preservation.

Permanent residency available

The Swiss Residence Permit is valid for up to five years and can lead to permanent residency. After meeting residency requirements, applicants may apply for Swiss citizenship. This unlocks full rights and privileges within Switzerland and the EU. It’s a long-term solution for global mobility.

Establish Swiss operations

Non-EU nationals may obtain residency by relocating their business to Switzerland. This includes hiring local staff and contributing to the Swiss economy. It’s a strategic move for entrepreneurs seeking European access. The programme supports innovation and economic development.

Residency for retirees

Individuals over 55 may apply for Swiss residency for retirement purposes. Applicants must demonstrate financial means and a genuine link to Switzerland. This route offers a peaceful and secure lifestyle. It’s ideal for retirees seeking stability and quality of life.

Swiss Residency for Non-EU Citizens is granted by virtue of the Federal Act on Foreign Nationals, whilst Residency Permit for EU citizens is granted on the basis of the Free movement Agreement with the European Union.

Relocate to Switzerland with ease

For EU residents:

- EU citizens qualify for a fast-track route as well as a privileged access to Swiss Residency;

- SWISS RESIDENCY PERMIT WITH GAINFUL EMPLOYMENT:

- An employment agreement with a Swiss employer or become self-employed in Switzerland;

- SWISS RESIDENCY PERMIT WITHOUT GAINFUL EMPLOYMENT:

- Sufficient financial means;

- An adequate health and accident insurance.

For non EU residents:

- FOR RETIREMENT PURPOSES:

- Over 55 years old;

- Investment in a company (to be negotiated with authorities) ;

- Proof of genuine link to Switzerland;

- FOR INVESTMENT PURPOSES:

- Investment in a company (to be negotiated with authorities)

- Proof of genuine link to Switzerland;

- FOR BUSINESS PURPOSES:

- Relocate a business to Switzerland;

- Hire locals.

Who is this for

This solution is ideal for EU and non-EU nationals seeking Swiss residency through retirement, investment, or business relocation.

Ideal For:

- High-net-worth individuals

- Entrepreneurs and retirees

- Families seeking EU access

- Investors seeking favourable tax regimes

Why this country

Why Switzerland?

Switzerland is renowned for its neutrality, safety, and global connectivity. It’s a top choice for investors and families seeking long-term European residency.

Country Highlights:

- Political and economic stability

- High quality of life

- Favourable tax environment

Key Contacts

Dr. Jean-Philippe Chetcuti

Dr. Antoine Saliba Haig

Marina Magri

Magdalena Velkovska

Relocate to Switzerland with ease

Requirements

Swiss Residency Legal Basis

Swiss residency for non-EU citizens is governed by the Federal Act on Foreign Nationals. EU citizens benefit from the Free Movement Agreement with the EU. These legal frameworks ensure structured and compliant access to Swiss residency. They support various routes including employment, retirement, and investment.

Swiss Residency Eligibility

EU citizens may apply with or without employment. Non-EU nationals qualify through retirement, investment, or business relocation. Applicants must demonstrate financial means and a genuine link to Switzerland. Health insurance and clean criminal records are required.

Swiss Investment Routes

Non-EU applicants may invest in Swiss companies or relocate their business. Retirement applicants must be over 55 and show financial stability. Investment terms are negotiated with Swiss authorities. All routes must demonstrate economic or social contribution.

Due Diligence & Vetting

Applicants undergo a fit and proper test including background checks. Swiss authorities assess financial means and genuine links to the country. Compliance with legal and immigration standards is essential. This ensures integrity and transparency throughout the process.

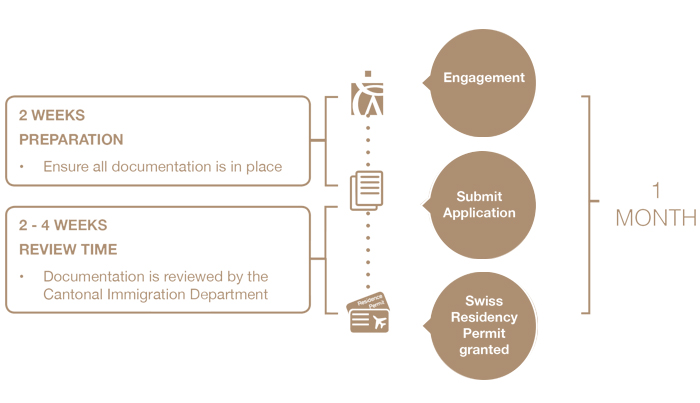

Process/Timeline

Assess eligibility and goals

Our advisors evaluate your profile and determine the most suitable route to Swiss residency. We consider retirement, investment, or business relocation options. This step ensures strategic alignment with your goals. It sets the foundation for a successful application.

Compile legal documentation

We assist in gathering all required documents including financial statements, health insurance, and proof of genuine link. Our team ensures accuracy and compliance. This step is critical for smooth processing. It minimises delays and maximises approval chances.

Complete qualifying investment

Applicants proceed with the selected investment or business relocation. Our legal and financial teams provide full support. We liaise with Swiss authorities to ensure compliance. This step confirms your commitment to Swiss residency.

Submit to Swiss authorities

We file your residency application and manage communications with Swiss immigration. Our team monitors progress and provides updates. This step ensures professional representation. It leads to timely approval and permit issuance.

FAQs

[question]What are the Swiss residency options for non-EU nationals?[/question]

[answer]Non-EU nationals may apply for Swiss residency through retirement,investment, or business relocation. Each route has specific requirements and benefits. Our advisors help determine the best option for your profile.[/answer]

[question]Can I include my family in the Swiss Residence Permit?[/question]

[answer]Yes, the programme allows inclusion of spouse and children. Family members enjoy the same residency rights. This ensures unity and access to Swiss services.[/answer]

[question]Does Swiss residency lead to citizenship?[/question]

[answer]Yes, after maintaining residency for several years, applicants may apply for Swiss citizenship. This grants full rights and privileges. It’s a long-term solution for global mobility.[/answer]

[question]Is there a minimum stay requirement for Swiss residency?[/question]

[answer]No minimum stay is required for permit retention. However, tax residency applies if residing over 183 days. Our advisors guide you on compliance and benefits.[/answer]

[question]What is the tax treatment for Swiss residents?[/question]

[answer]Swiss residents are taxed only on Swiss-sourced income unless they reside over 183 days. The regime is favourable for global investors. It supports wealth preservation and planning.[/answer]